How to use prepayments and deposits for restaurant reservations

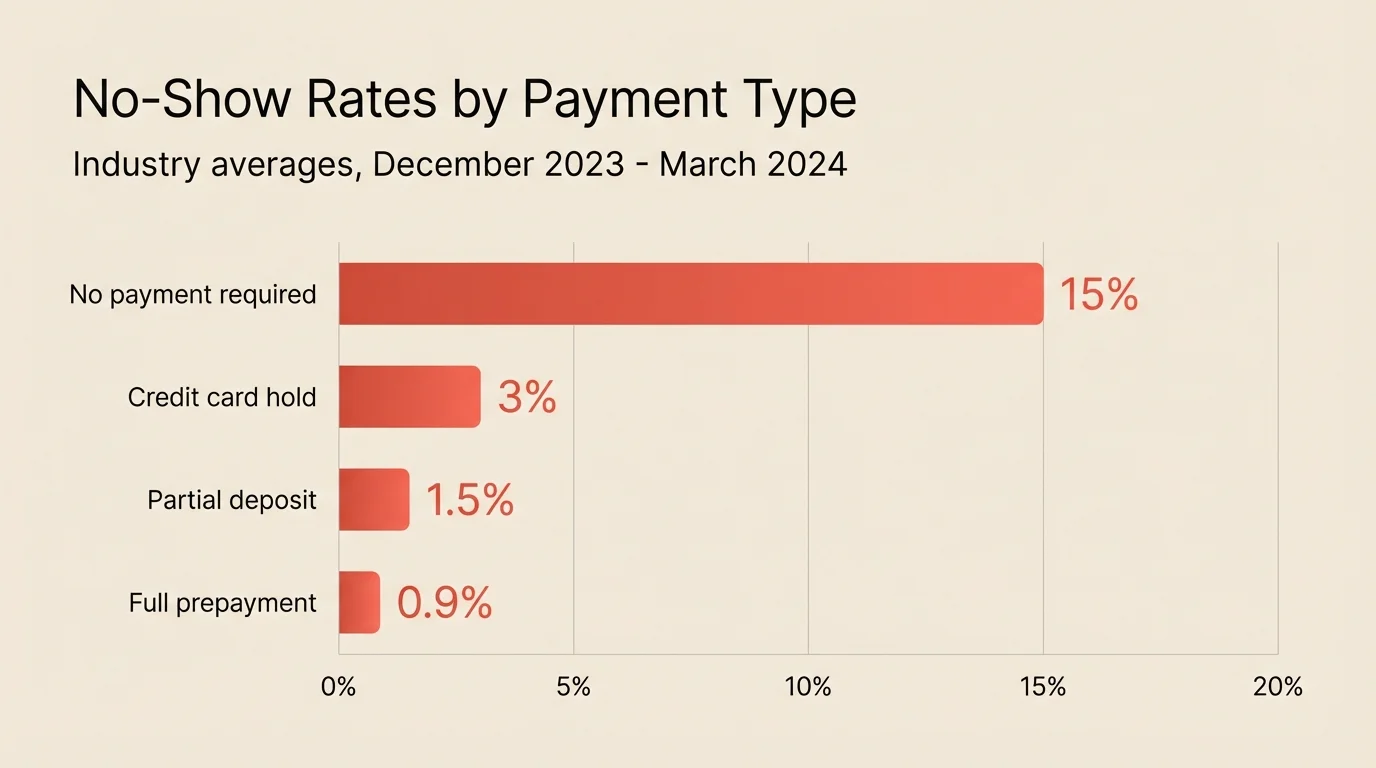

To implement deposits effectively, you need to set the right amount, apply them to the right bookings, and communicate clearly with guests. Restaurants using deposits see no-show rates drop from 15% to under 2%, recovering thousands in monthly revenue.

A reservation without commitment is just a maybe. The psychology is simple: people value what they pay for. A free reservation costs nothing to abandon. A $25 deposit creates skin in the game. But deposits do more than reduce no-shows. Prepaid guests spend 30-35% more on average and cancel 72% less often at the last minute.

Key takeaways

- Main solution: Strategic deposits for high-risk bookings + clear refund policy + apply to final bill

- Expected result: 50-90% reduction in no-shows, 30%+ increase in guest spending

- Time to implement: 1-2 hours for setup, ongoing management minimal

- Cost: Payment processing fees only (typically 2.9% + $0.30 per transaction)

Before you start

Deposits work best when you understand your current situation and have clear goals.

What you’ll need:

- Reservation system with payment collection capability

- Payment processor (Stripe, Square, or built-in)

- Clear cancellation policy language

- Staff trained on communicating the policy

Know your numbers: Calculate what no-shows cost you monthly:

For a 50-seat restaurant with 10% no-shows at $75 average check:

- Monthly covers expected: 3,000

- No-shows at 10%: 300

- Direct revenue loss: $22,500

That’s a strong case for implementing deposits.

Step 1: Choose your payment structure

Different situations call for different approaches. Match the structure to your operation.

What to do:

- Review your booking types and risk levels

- Select the appropriate structure for each

- Document your approach for consistency

- Train staff on the differences

Payment structures:

| Type | How it works | Best for |

|---|---|---|

| Full prepayment | Guest pays entire meal cost upfront | Tasting menus, special events, omakase |

| Partial deposit | $20-50 per person, applied to bill | Fine dining, high-demand times |

| Credit card hold | Card charged only if guest no-shows | Casual upscale, everyday reservations |

| Cancellation fee | Flat fee charged for late cancels/no-shows | Broad applicability, lower friction |

Pro tip: Start with credit card holds if you’re nervous about guest reaction. They provide protection without upfront charges. Graduate to deposits once you see the impact.

Step 2: Set the right deposit amount

The deposit needs to be meaningful but not prohibitive. Too low and it won’t change behavior. Too high and you’ll scare off legitimate guests.

What to do:

- Consider your average check when setting amounts

- Match amounts to restaurant type and guest expectations

- Test amounts and adjust based on booking impact

- Keep amounts consistent for similar booking types

Deposit guidelines by restaurant type:

| Restaurant type | Suggested deposit | Notes |

|---|---|---|

| Casual dining | $5-15 per person | Enough to deter casual no-shows |

| Upscale casual | $15-25 per person | Standard for busy weekend slots |

| Fine dining | $25-50 per person | Higher commitment matches higher prices |

| Tasting menus | Full prepayment | Price transparency, no surprises |

| Special events | 50-100% prepayment | Protects against significant loss |

A $25 deposit on a $40 meal feels heavy. The same $25 on a $150 dinner feels proportional. Consider the ratio, not just the amount.

Step 3: Decide when to require deposits

Not every reservation needs a deposit. Strategic application maximizes commitment without creating unnecessary friction.

What to do:

- Identify your highest-risk booking scenarios

- Implement deposits for those scenarios first

- Track results before expanding

- Create exceptions for loyal guests if appropriate

Always require deposits for:

- Weekend dinner service (Friday-Sunday)

- Large party bookings (6+ guests)

- Peak hours and special occasions

- Holidays (Valentine’s Day, Mother’s Day, New Year’s Eve)

- Guests with previous no-show history

- Limited-seating experiences or tasting menus

Consider skipping deposits for:

- Weekday lunch

- Regular guests with strong track records

- Off-peak times when you have excess capacity

- Markets where deposits aren’t culturally expected

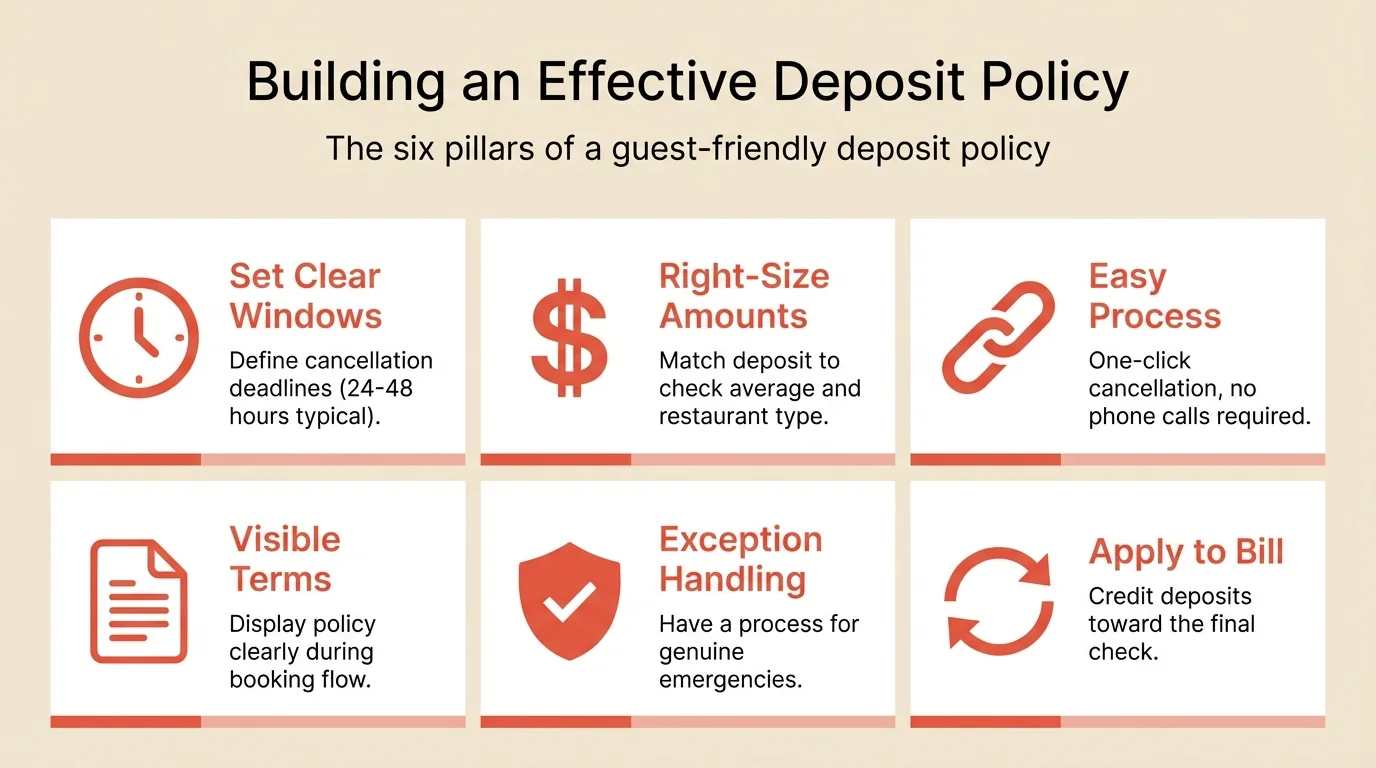

Step 4: Create a clear cancellation policy

Your cancellation policy determines whether deposits feel fair or punitive. The best policies balance protection with flexibility.

What to do:

- Define your cancellation window (24-48 hours standard)

- Write the policy in plain language

- Make the process easy (one-click cancellation)

- Document exception handling for emergencies

Policy elements to include:

- Clear cancellation window (24-48 hours before reservation)

- Easy cancellation process (one click, not a phone call)

- What happens to the deposit (refunded, applied, forfeited)

- How to handle emergencies (unwritten flexibility is fine)

Sample policy language: “Cancellations made more than 24 hours before the reservation receive a full refund. Late cancellations and no-shows forfeit the deposit. Your deposit will be applied to your bill when you dine with us.”

Step 5: Set up your payment system

The technical implementation needs to be seamless for guests and staff.

What to do:

- Enable payment collection in your reservation system

- Connect your payment processor

- Configure deposit amounts by booking type

- Test the guest experience yourself

Before launch checklist:

- Payment processor connected and tested

- Deposit amounts configured correctly

- Policy language displays during booking

- Confirmation emails include policy summary

- Staff know how to process deposits and handle questions

Technical requirements:

- PCI-compliant payment processing

- Automatic deposit application to final bill

- Refund capability for cancellations within window

- Reporting on deposits collected and forfeited

Step 6: Communicate the policy effectively

How you communicate deposits matters as much as the policy itself. Done well, guests understand and accept. Done poorly, you’ll face pushback.

What to do:

- Show deposit amount and policy before card entry

- Explain that deposits apply to the final bill

- Train staff to explain confidently and positively

- Prepare responses for common objections

During the booking process:

- Display deposit amount clearly before checkout

- Show cancellation window and refund policy

- Confirm that deposit applies to final bill

- Send immediate confirmation with policy summary

If guests push back: “We introduced deposits to ensure we can hold your table and not turn away other guests. The deposit applies directly to your bill, so it doesn’t cost you anything extra. It just confirms your commitment.”

Pro tip: Most guests who object weren’t planning to show up anyway. The ones who book despite deposits are your best customers.

Step 7: Monitor and adjust

Track results and refine your approach based on data.

What to do:

- Track deposit conversion rates (bookings started vs. completed)

- Monitor no-show rates by deposit vs. non-deposit bookings

- Review forfeiture rates monthly

- Adjust amounts or timing based on results

Metrics to track:

| Metric | What it tells you | Target |

|---|---|---|

| Booking conversion | Are deposits scaring guests away? | 85%+ completing checkout |

| No-show rate (deposit bookings) | Are deposits working? | Under 2% |

| Deposit forfeiture rate | Catching genuine no-shows | 3-5% |

| Average check (deposit vs. non) | Spending difference | Deposit guests 20%+ higher |

A high forfeiture rate (over 5%) suggests your deposits are catching genuine no-shows. A very low rate means deposits work as a deterrent, which is also success.

Common mistakes to avoid

Setting deposits too low

A $10 deposit on a $200 dinner won’t change behavior. Match the amount to the stakes.

Applying deposits everywhere

Deposits for Tuesday lunch at a half-full restaurant creates friction without benefit. Target high-risk scenarios.

Making the policy hard to find

Surprise deposits create angry guests. Show the policy clearly before payment.

Inconsistent enforcement

Waiving deposits for some guests teaches everyone to ask for exceptions. Be consistent.

Forgetting to apply to the bill

Guests expect their deposit to count toward their meal. Make sure your system handles this automatically.

How to measure success

Track these metrics before and after implementing deposits:

| Metric | Before (example) | Target | How to track |

|---|---|---|---|

| No-show rate (deposit bookings) | 15% | Under 2% | System reporting |

| Overall no-show rate | 12-15% | Reduce by 50%+ | System reporting |

| Average check (deposit guests) | $75 | 20-30% higher | Compare segments |

| Booking conversion | 80% | 85%+ | Checkout completion |

Calculate your ROI:

Tools that help

Modern reservation systems handle deposit collection seamlessly.

Payment processing integrated directly into booking flow collects deposits without friction. Look for systems with built-in Stripe or Square integration.

Automatic application credits deposits to final bills without manual intervention. The guest sees their deposit already applied when the check arrives.

Flexible policies let you set different deposit amounts for different scenarios. Large parties get one amount, peak times another.

Reporting shows you deposit conversion, forfeiture rates, and no-show comparisons so you can optimize over time.

If your current system doesn’t support deposits, Resos’s reservation system includes built-in payment collection with no per-cover fees.

Frequently Asked Questions

How much should I charge for a restaurant reservation deposit?

Do prepayments actually reduce no-shows?

Should deposits be refundable or non-refundable?

Will requiring deposits hurt my bookings?

What's the difference between a deposit and a prepayment?

The bottom line

Deposits transform reservations from hopeful placeholders into confirmed revenue. Start with your highest-risk bookings: Saturday nights and large parties. Set amounts that feel proportional to your check average. Make your policy clear and your cancellation process easy.

The restaurants winning the no-show battle aren’t hoping guests will behave. They’re designing systems that guarantee commitment. Prepayments turn reservations into revenue.

Related guides: How to reduce no-shows | How to reduce cancellations | Large party bookings

Ready to improve your operations?

See how Resos can help you put these insights into practice.

Start Free with Resos